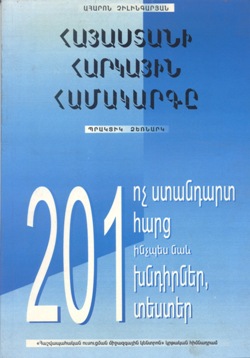

AHARON

CHILINGARYAN

"TAX SYSTEM OF THE RA - 201 NON STANDARD QUESTIONS AS

WELL AS TASKS, TESTS"

This publication represents a selection of current Tax Legislation of the

RA, questions and tasks concerning the Tax System of the RA. 201 non standard

questions are given in accordance with topics: six types of taxes in use of

the RA, Fixed Payments, Simplified Tax, State Duties, State Obligatory Social

Security Payments, Transportation Payments, Ecological Payments, Local Duties

and Payments, Tax Regulations, Application of International Tax Regulations.

The questions are mainly of non-standard kind for which, in many cases, there

are no direct and simple answers.

This publication represents a selection of current Tax Legislation of the

RA, questions and tasks concerning the Tax System of the RA. 201 non standard

questions are given in accordance with topics: six types of taxes in use of

the RA, Fixed Payments, Simplified Tax, State Duties, State Obligatory Social

Security Payments, Transportation Payments, Ecological Payments, Local Duties

and Payments, Tax Regulations, Application of International Tax Regulations.

The questions are mainly of non-standard kind for which, in many cases, there

are no direct and simple answers.

The manual is designed not only for tax and audit professionals, accountants and accounting specialists, but also for a wide scope of society, who would like to gain some knowledge in the area of Tax System of the RA.

ABOUT

THE AUTHOR

Aharon Chilingaryan graduated Yerevan State Institute

of Economics and worked in different scientific and production organizations

till 1992. During 1992 - 1998 worked in Tax Inspectorate of the RA as Head

of Department, then Head of Taxation Mechanisms Regulating Department. In

1998 he is appointed Deputy Minister of Statistics, State Register and Analysis.

He is a Third Class State Tax Service Advisor of the RA, member of Board of

Association of Accountants and Auditors of Armenia, President of Business

Law and Tax Legislation Committee.

From May 2000 is appointed member of State Board of Statistics of the RA. He is a lecturer in Yerevan State Institute of Economics, financial-banking faculty, leads practical seminars at "International Accountancy Training Centre" Educational Fund.

The book is available at IATC Fund and in the main book stored of Yerevan.